These Graphs Show the Stabilization of the Market

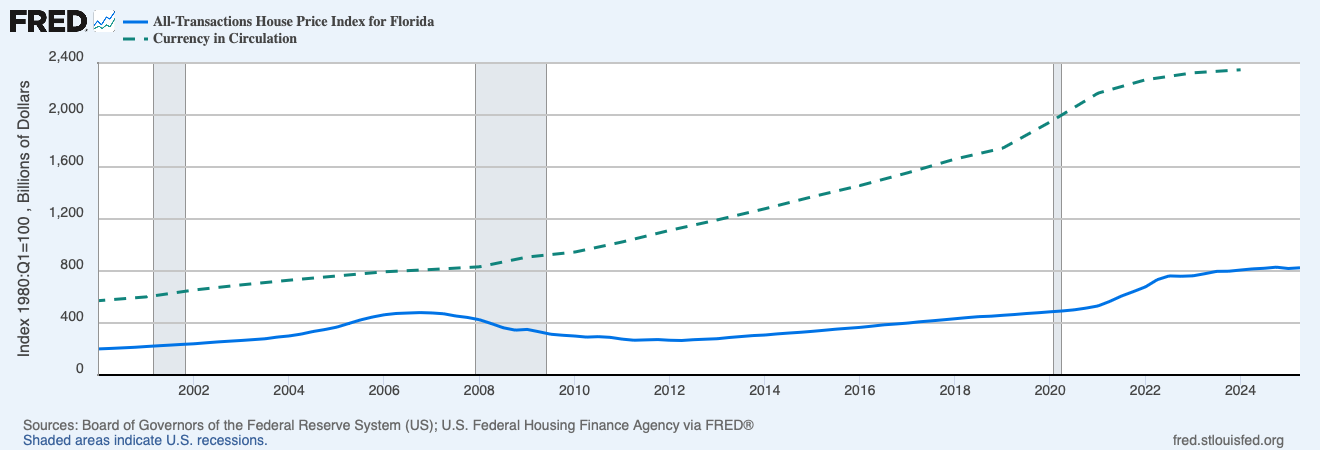

These charts highlight the link between money supply and real estate prices in Florida. As liquidity expands, asset values typically rise—much like an apple costing $1 will double in price if money in circulation doubles. The exception occurs when banks restrict lending, preventing new capital from reaching the market. Once lending resumes, the correlation between monetary expansion and rising real estate values is restored.

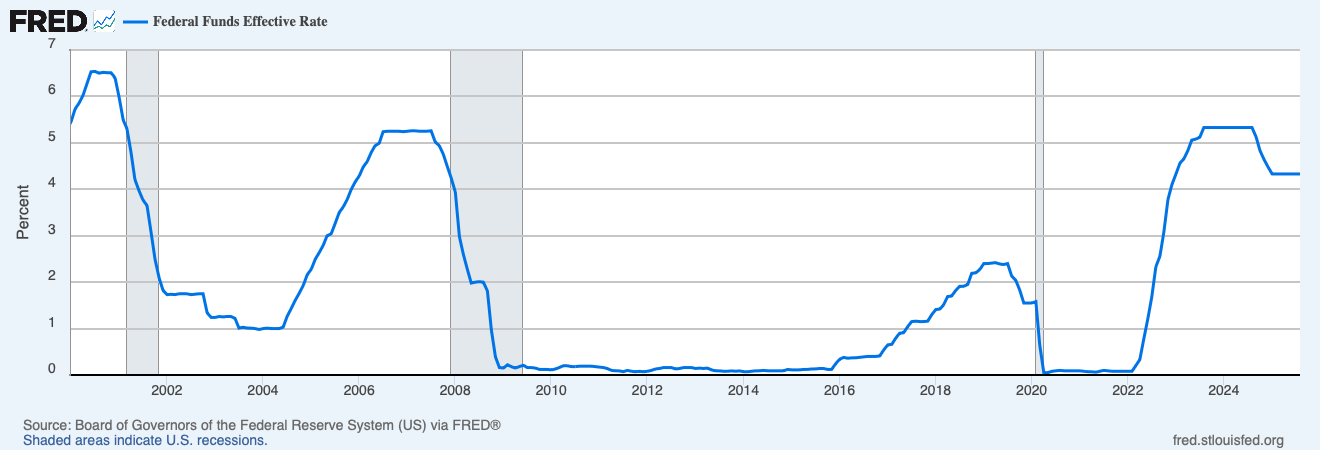

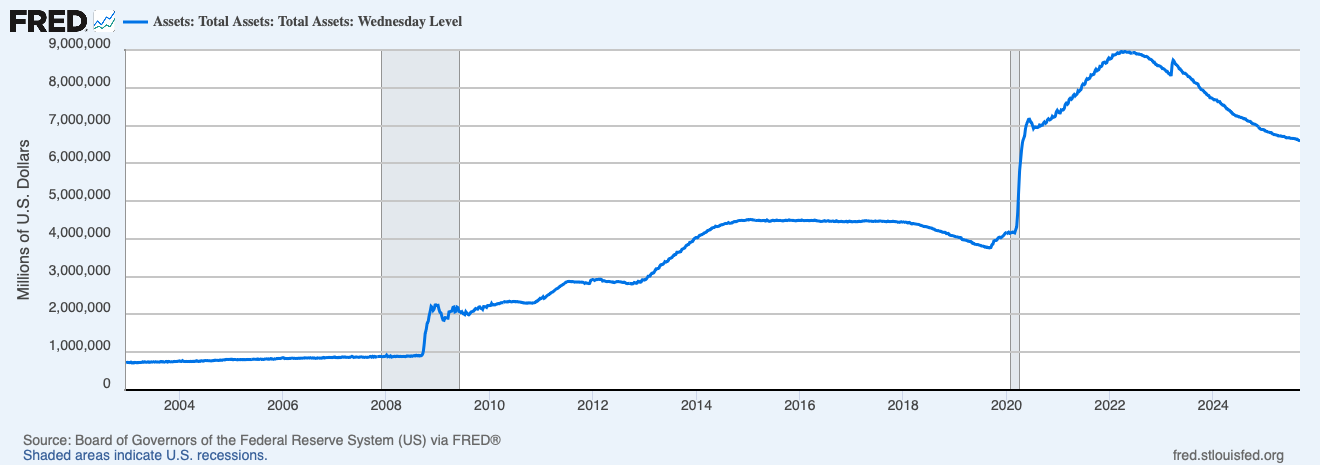

These charts demonstrate that the true catalyst for bank lending, economic growth, and broader money circulation is the initiation of a rate-cutting cycle. Typically, the sequence begins with a modest reduction in rates. Once economic activity stabilizes, the Federal Reserve reinforces this by expanding liquidity—lowering reserve requirements—and subsequently allowing rates to decline further. When overlaying the historical data, a clear pattern emerges: as inflation accelerates, the Fed responds by raising both reserves and interest rates. Conversely, when the economy requires stimulus, either reserves are reduced or interest rates are lowered, thereby releasing liquidity into the system. The current decrease of the Federal Reserve Balance Sheet points out that the clear understanding that the Federal Reserve is trying to reduce too much liquidity in the market. Lower rates with ample liquidity leads to high inflation. As a result, the decrease of the FED balance sheet shows the high probability of a much lower rate environment in the near future.